Are you considering choosing a premium financing option for your business insurance?

An increasingly popular option for businesses struggling with, or simply wanting to improve, their cash flow, insurance premium financing allows you to make monthly insurance payments – but at what hidden costs?

Keep reading for exactly how premium financing works, the benefits of choosing it, and what other options are available to your business.

An insurance premium in general is the payment that you, the policyholder, agree to pay for your insurance. In return for the premium payments, the insurance company guarantees protections as outlined in your policy.

Calculating these insurance premiums involves a complex process. The insurance company considers any number of factors, like the likelihood of an accident, the probability of a claim being filed, and how much they’d be likely to have to pay out if a claim does manifest.

This can often be expensive and may create cash flow problems for some businesses – which is where insurance premium financing comes into play.

Financing your commercial insurance allows you as a business owner to pay your premium in monthly installments (plus interest) rather than a large annual payment upfront, helping to manage and stabilize cash flow.

There are three main types of premium financing arrangements:

Each type of premium financing comes with its own set of advantages and disadvantages, and the choice between them depends largely on the specific needs and circumstances of the policyholder. However, every option comes with one unavoidable disadvantage: added interest.

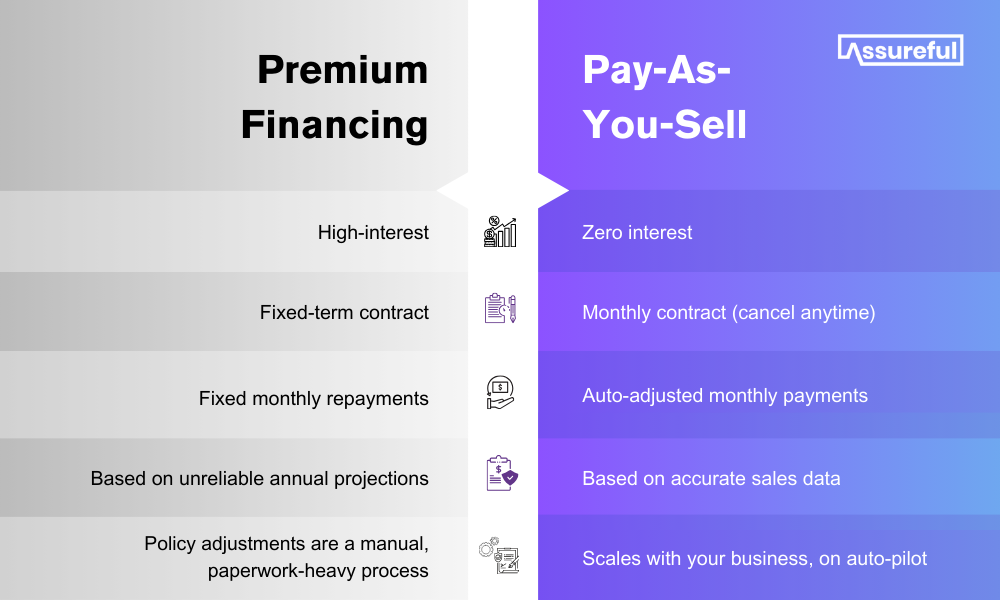

That’s why at Assureful, we offer pay-as-you-sell general liability insurance instead. So eCommerce sellers can get no interest, no commitment insurance from just $26 per month.

Understanding the process of premium financing in insurance can help you make an informed decision about whether this financial strategy is right for your business versus upfront payment or pay-as-you-sell models. There are four key steps involved in premium financing:

First, you must apply to the premium finance company, providing information about your financial situation, the insurance policy you wish to finance, and any collateral you’re offering so the premium finance company can evaluate the risk associated with the application.

Once the application is approved, the finance company will finalize the loan terms including the interest rate, repayment schedule, and any fees associated with the financing. Then both parties will sign a loan agreement and your premium finance company will pay your insurance premium directly to your insurance company.

In most arrangements, you’ll be required to provide collateral or security in the event of a loan default.

You’ll be required to make regular repayments according to the agreed schedule (usually monthly). Once the loan is fully paid, your payments are terminated and you retain full ownership and control of the insurance policy.

One of the main benefits of premium financing is, of course, better cash flow management.

By spreading out the cost of insurance over time, you can avoid large upfront payments, especially if you’re facing a large premium. This can be particularly beneficial for small businesses and startups, where cash flow is often a critical concern. But, it doesn’t come without its costs. The more you borrow, the more you’ll owe in interest.

Another potential benefit of premium financing is the possibility of tax deductions. The interest paid on the loan may be tax-deductible, although it’s important to speak to a tax specialist to understand the specific implications for your situation.

It can also be used as part of an asset protection strategy. By financing insurance premiums, businesses can protect their assets while also maintaining liquidity.

Disclaimer: We are insurance specialists, not tax specialists. Always consult a specialist in taxation before making decisions about tax benefits.

While insurance premium financing does offer some benefits, it’s important to be aware of the potential risks and disadvantages as well.

One of the main drawbacks of premium financing is the increase in overall cost caused by high interest and add-on fees. These add up over time, especially on high-value premiums, making the total cost of the insurance policy much higher than if it were paid upfront or via a pay-as-you-sell model.

Insurance premium finance is considered a loan, not simply a swap to a pay-monthly model. As with any loan, it’s important to carefully consider the terms and conditions before entering into a financing arrangement.

You’re tied into a contract to repay the loan for a specified period and can’t simply cancel should your sales drop. If you’re unable to make a payment in any given month, your business could be left uninsured. This can have serious implications and leave your business uninsured against liability claims.

In some cases, the use of premium financing can actually result in reduced policy benefits because the loan amount and associated interest reduce the cash value of the policy. This in turn reduces the potential payout in the wake of a claim.

Similar to other types of loans, the premium financing company may ask you to put up collateral to acquire financing, putting your assets at risk in the case of missed payment.

Premium financing is a complex strategy that can provide a way to manage cash flow, secure substantial insurance coverage, and protect assets. However, it also comes with increased costs, potential risks, and often collateral requirements.

That’s why we created our pay-as-you-sell model – to capture all the benefits of premium financing and negate the downside. Easily integrated with all major eCommerce platforms like Amazon and Walmart, our model monitors your sales in real-time to adjust your premium based on actual sales every single month. Covering what you need when you need it.

It gives eCommerce businesses the flexibility to scale their insurance premiums alongside their business, without the burden of high interest payments or the risk of inaccurate coverage.

At Assureful, we’re committed to providing our clients with the information and resources they need to make informed decisions about their liability insurance. Find out more about our eCommerce liability insurance, or sign up to get your free quote today.

Save On My eCommerce InsuranceNo obligation quote.

Policies can be canceled at any time, with 30 days’ notice.